U.S. Crypto Adoption Boosted by Two Key Factors as Revealed by Chainalysis

In the dynamic world of finance, the United States has been making waves with the growth of Exchange-Traded Funds (ETFs) focused on cryptocurrencies. These funds, which currently manage an impressive $24 billion in assets, have become a significant player in the intersection of traditional finance and the crypto market.

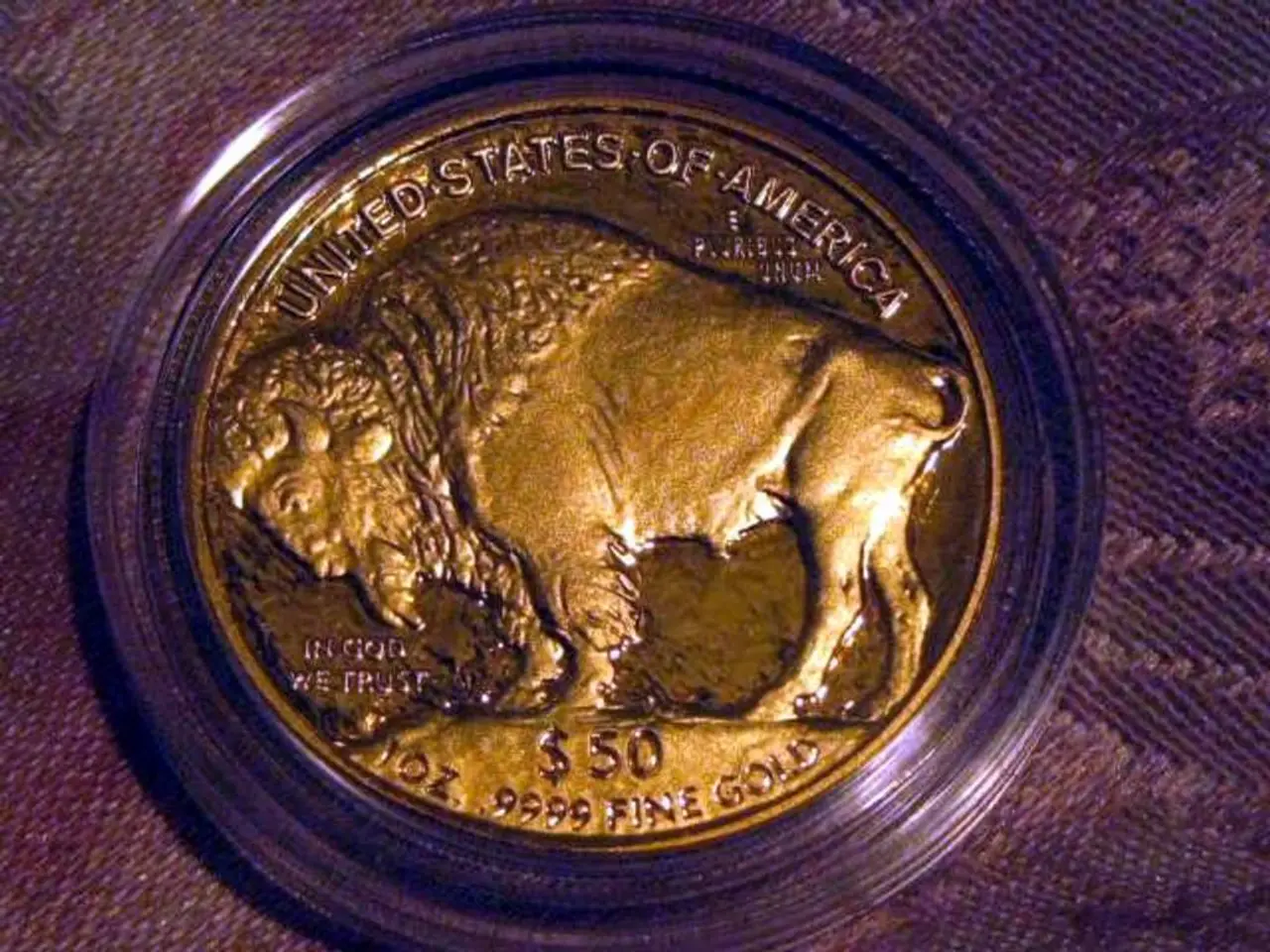

One of the most intriguing developments is the surge in Bitcoin ETFs. These funds offer mainstream investors a chance to gain exposure to Bitcoin without the need to manage private keys or hold the asset directly. The US-listed Bitcoin ETFs have amassed more than $120 billion, demonstrating the United States' outsized role in driving this trend.

The growth of Bitcoin ETFs is not just a standalone phenomenon. It ties demand more closely to US monetary policy and stock market today cycles, thereby intensifying correlations with broader risk assets. This correlation was evident in December 2024, when a historic peak of $244 billion in received transactions was recorded, driven by record-breaking stablecoin transfers.

Tokenized treasuries have seen an explosion in the US, with assets under management (AUM) in tokenized money market funds nearly quadrupling, from around $2 billion in August 2024 to over $7 billion in August 2025. These funds offer investors regulated, on-chain, yield-bearing products that combine the liquidity of crypto with the safety of government-backed debt.

The growth of Bitcoin ETFs and tokenized assets is reshaping the landscape, with the growth of Ethereum ETFs potentially receiving a boost from the potential approval of Solana ETFs. North America, in particular, stands out for its volatility, with transaction growth swinging from a 35% drop in September to an 84% jump in November. Much of this volatility is attributed to institutional strategies and trading patterns that amplify market movements.

The US presidential election in November 2024 was a catalyst for the surge in transactions in December 2024. Centralized exchanges saw significant activity, with $2.7 trillion worth of Bitcoin purchases in USD, $1.5 trillion in ETH, and $454 billion in USDT.

Despite the volatility, the US secured the number two spot in the Chainalysis 2025 Adoption Index. The growth of these ETFs is reshaping the traditional finance and crypto markets, offering stable returns and serving as collateral for DeFi protocols and fintech platforms. As we move forward, it will be interesting to see how this trend continues to evolve.

Read also:

- Show a modicum of decency, truly

- Advanced Brabus Model Not Suitable for Inexperienced Drivers

- Latest Developments in Electric Vehicle, Battery, and Charging: IBM, Tervine, ACM, Clarios, Altris, 25M, Lion Electric, InductEV, EVgo, Toyota, EVCS, StoreDot, and REE Are in Focus

- Latest updates for July 31: Introduction of Ather 450S with expanded battery, unveiling of new Tesla dealership, and additional news