Ripple Allegedly Offering Circle a $20 Billion Deal, According to Unsubstantiated Reports - Skepticism Remains Among XRP Investors

Ditch the $20 Billion Ripple-Circle Merger Hype

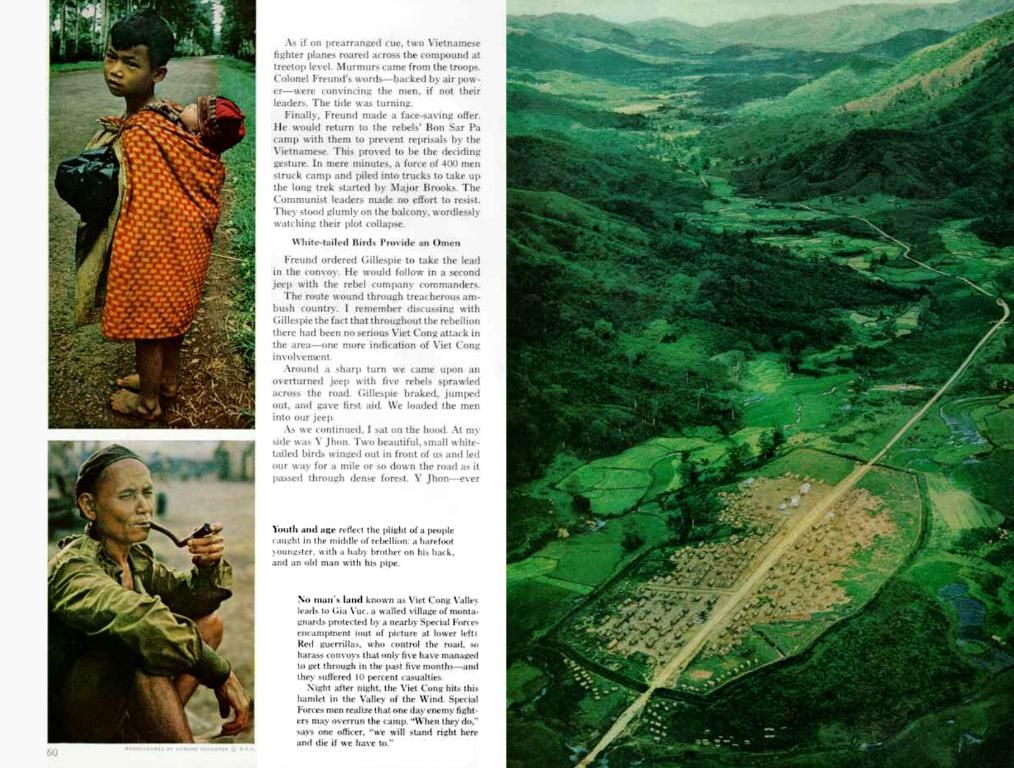

Stop believing the chatter, folks! The latest buzz about Ripple forking out a whopping $20 billion to acquire USDC issuer Circle is nothing but a hoax.

Today, this unfounded theory went viral on the X platform, with some influencers and crypto media outlets spreading the rumor without any solid evidence to back it up. The XRP community slammed these platforms for irresponsible reporting.

Dom Kwok, cofounder of EasyA, put it bluntly - "No way" Ripple would cough up such astronomical cash. Just last month, Circle filed for a $5 billion IPO.

Rumor Mill: Analyzing the News Bits

Let's take a closer look at the rumor's roots. According to X search history, the rumor seems to have sprouted on April 30th, stemming from a sketchy account claiming the offer had increased to $20 billion. The account also insinuated that the deal was finalized, but it was tagged "Fox News," without any actual reporting from the news network.

Rebounding Ripple after a Slump

Interestingly, the XRP price surged earlier on rumors of ProShares securing approval to launch XRP exchange-traded funds on April 30. However, the launch date remains uncertain.

In the past, Ripple and Circle have crossed paths when it comes to stablecoins. Circle is the second-largest player in the stablecoin market, with a capitalization of USDC surpassing $61 billion. The company's main revenue stream comes from the interest earned on the reserves backing the popular stablecoin. Ripple entered the stablecoin market last year with the introduction of Ripple USD (RLUSD).

Circle Age: The Upcoming Cross-border Payments Network

Adding another layer to the competition, Circle also announced the launch of a cross-border payments network in April. This move places them directly in competition with Ripple in their department.

The initial Bloomberg report suggested that Ripple offered up to $5 billion to acquire Circle, but the offer was declined. However, it's essential to note that there's no credible reporting confirming the $20 billion offer. Experts view the $20 billion figure as highly speculative, with a more realistic bid coming in at around $6-6.5 billion[1][2][3].

The alleged $20 billion offer is primarily based on unconfirmed sources and hasn't been officially acknowledged by either Ripple or Circle[2][3][4]. Plus, Coinbase's stake in Circle could potentially complicate any potential acquisition attempt[3].

#Ripple vs. Circle, Round 2

Stay informed and sift through the noise - that's the XRP army's mantra! Keep your eyes on the market and don't let unsubstantiated rumors sway your investing decisions.

- Despite widespread rumors, the alleged $20 billion offer from Ripple to acquire Circle is purely speculative and unconfirmed.

- The $20 billion offer, allegedly made by Ripple to USDC issuer Circle, appears to be based on unconfirmed sources and hasn't been officially acknowledged by either party.

- With Circle's cross-border payments network launch and Ripple's Ripple USD (RLUSD), the competition between these two finance businesses in the stablecoin market intensifies.

- The rumor of a $20 billion offer from Ripple to Circle spread like wildfire across the crypto and influencer community, but was questioned for lack of solid evidence to support it.

- Experts raise doubts about the $20 billion figure, suggesting that a more realistic bid may be around $6-6.5 billion, while Coinbase's stake in Circle could potentially complicate any potential acquisition attempt.

- As the competition between Ripple and Circle grows, the XRP community encourages investors to stay informed and make investment decisions based on substantiated news instead of unfounded rumors.