Regulation push by Bank of Ghana demands Virtual Asset Service Providers to register

The Bank of Ghana (BoG) has taken a significant step in promoting innovation and safeguarding the country's citizens by announcing the registration of Virtual Asset Service Providers (VASPs) on July 10, 2025. This move is part of Ghana's commitment to align its crypto rules with global standards and build a comprehensive regulatory framework.

All VASPs operating in Ghana, both domestic and foreign, are required to register with the BoG by August 15, 2025. This registration applies to companies offering crypto exchange, wallet, custody, and token-related services to Ghanaian customers. While this registration is not yet a full licensing process, failure to comply may result in penalties or exclusion from future licensing programs.

Following the registration phase, Ghana plans to formally license VASPs starting September 2025 through the upcoming Virtual Asset Providers Act. This act will establish a robust regulatory framework, including licensing requirements, consumer protections, anti-money laundering (AML) and know-your-customer (KYC) compliance, cybersecurity audits, minimum capital thresholds, and tax obligations.

The aim of these regulations is to enhance transparency, prevent illegal activities such as money laundering and fraud, and improve monetary policy effectiveness amid rising crypto adoption. The Bank of Ghana's governor, Johnson Asiama, has emphasized that these measures will enable better monitoring of payments and support inflation targeting and exchange rate management in light of the cedi’s recent volatility.

Ghana has seen significant cryptocurrency adoption, with approximately 17% of the adult population (over three million Ghanaians) engaged in crypto transactions, amounting to about $3 billion in trade from mid-2023 to mid-2024. The BoG's secretary, Sandra Thompson, signed a release regarding the regulation of cryptocurrencies and virtual assets.

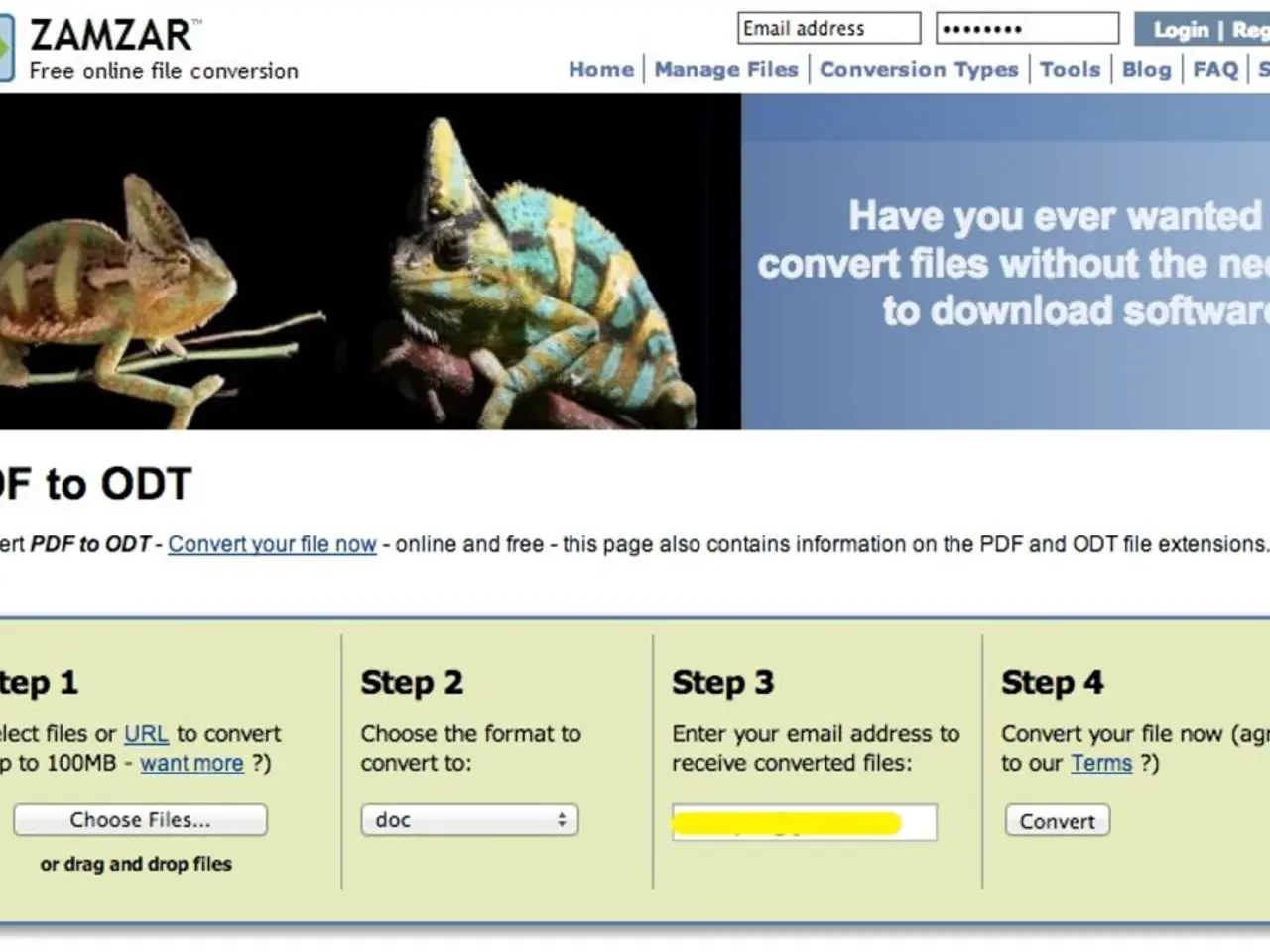

It is important to note that the regulatory process for cryptocurrencies in Ghana is not a full license-issuance endeavor by the BoG at this stage. However, the institution of these crypto rules is contingent on the passage of the VASP act by Ghana's lawmakers. The BoG has asked virtual assets service providers to fill out and submit a registration form on its website by mid-August.

The regulatory process for cryptocurrencies in Ghana has been picking up steam. Ghana is another African country looking to properly regulate cryptocurrencies and virtual assets, joining the ranks of countries like Nigeria and South Africa. Authorities reiterated the ban on dealing with digital assets in early 2023, and local banks are prohibited from dealing with digital assets.

In summary, Ghana is currently in a transitional regulatory phase: mandatory registration of VASPs by mid-August 2025, followed by the issuance of licenses and full regulatory enforcement expected from September 2025 onwards under a formal legal framework. Companies required to register include cryptocurrency exchanges, wallet providers, payments companies utilizing digital assets to settle transactions, and projects looking to issue initial coin offerings and token sales. Compliance with this registration process is crucial for companies operating in the cryptocurrency space in Ghana.

- Ghana's commitment to innovation in the digital assets sector is evident as it aligns crypto rules with global standards, registering Virtual Asset Service Providers (VASPs) in line with the Bank of Ghana's (BoG) regulations announced on July 10, 2025.

- In a bid to improve financial and monetary policy effectiveness, the Bank of Ghana plans to formally license registered VASPs from September 2025, under the Virtual Asset Providers Act.

- The upcoming regulatory framework for VASPs in Ghana will encompass licensing requirements, consumer protections, anti-money laundering (AML) and know-your-customer (KYC) compliance, cybersecurity audits, minimum capital thresholds, tax obligations, and measures to enhance transparency.

- With approximately 17% of adults in Ghana participating in cryptocurrency transactions, the BoG's regulatory push is crucial in preventing illegal activities like money laundering and fraud and mitigating the cedi’s recent volatility in light of rising crypto adoption.

- The Ghanaian regulatory process for cryptocurrencies is evolving as it follows the registration of VASPs by August 15, 2025, aiming to provide a comprehensive regulatory framework similar to countries like Nigeria and South Africa in Africa's growing digital asset and finance business scene.