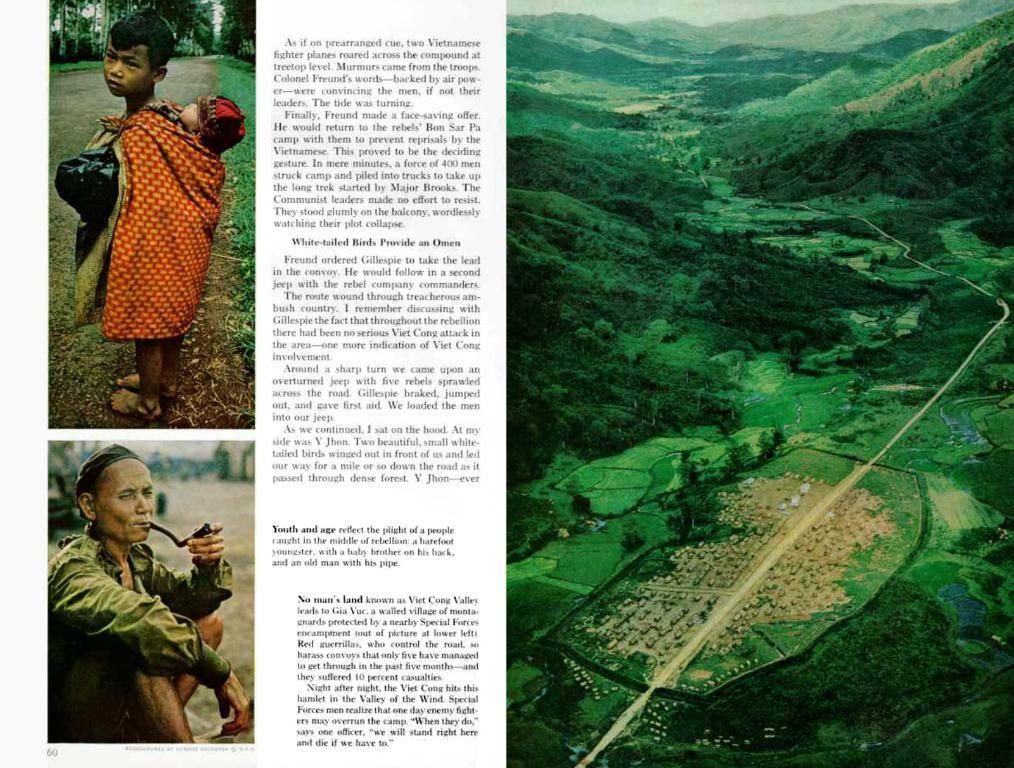

Public voicing concerns over branch closures: Lloyds and Natwest announce closure of multiple locations in the UK

Fed-Up Brits Face Lousy Customer Service as Bank Branches Shut Down

It's a cold hard truth: over half of Brits are struggling to find help when they need it most, with fresh research showing a staggering 6 in 10 consumers unable to get the support they require due to bank branch closures. This dismal state of affairs comes after a shocking 6,300 banking sites shuttered their doors in the past decade – that's around 53 closures a month, as per data from consumer watchdog Which.

Leading banks, Barclays and Natwest, have led the charge with 1,236 and 928 branch closures respectively. And things are only set to get worse, with 370 further closures slated for this year alone. Among the worst offenders, Halifax and Santander top the list with 99 and 95 closures apiece. Meanwhile, Barclays and Nationwide have sworn off further closures for now, hoping to win over more customers by staking a claim in the personalized customer service market.

Not surprisingly, one in five UK consumers are rattled by the continued closures, worried about the impact over the next five years. "The findings highlight the difficult tightrope that banks now need to walk, balancing the need to ensure their digital services remain cutting edge and up to scratch, which has become a competitive area for so many, without losing the personal touch that more traditional services offer," Sara Costantini, regional director for the UK and Ireland at CRIF, said.

Banks Turn a Blind Eye to Customer Woes

To add salt to the wound, more than half of respondents said banks are putting less emphasis on serving customers than they did five years ago. Despite customer pleas, a quarter of senior banking professionals dismiss business challenges related to closures, citing a successful transition to digital as justification.

Costanini called out this mindset, stating, "While many working in the sector don't see this as a major challenge to their business, bank branch reductions are continuing to fuel concerns over the quality of customer services and what further closures may mean for the future." According to Costanini, the shift toward digital banking is the reason for the branch reductions.

British banking heavyweights have been scrambling to bolster their tech offerings as they face mounting pressure from digital upstarts. In the last year, Lloyds Banking Group placed 6,000 IT jobs under review as part of its plan to "supercharge" its in-house tech expertise, and HSBC's operating expenses spiked 3% last year to $33bn, which the firm attributed to increased tech investments. The Financial Conduct Authority (FCA) even announced that City banks would be allowed to experiment with tech giant Nvidia's AI offering, launching a "supercharged sandbox" to speed up innovation.

Tech-Driven Banks Still Plagued with Outages

While banks are upgrading their tech, they've still stumbled over a string of outages that leave customers unable to access their accounts. Over the last two years, nine of the UK's biggest banks and building societies were down for a combined 803 hours – that's the equivalent of 33 days – according to Treasury Committee data. Just last Friday, Natwest customers joined the ranks of the outage casualties, experiencing issues with their mobile app. Firms have been quick to blame third-party suppliers for the outages, but the ongoing demand for in-person banking and cash services remains evident.

A brutal Treasury committee report warned that the UK could risk a "two-tier society" if the government fails to act on cash acceptance. Clearly, the challenges faced by customers and the banking industry are far from over.

- The increased emphasis on technology and digital services by banks is viewed as a competitive area, but concerns over the quality of customer service persist, with one in five UK consumers worried about the impact of continued branch closures over the next five years.

- Despite the focus on digital transformation, traditional banking services are still highly sought after, as ongoing issues with tech-driven outages continue to leave customers unable to access their accounts.

- As the banking industry grapples with the shift toward digital services and the resulting branch closures, it becomes increasingly important for banks to find a balance between offering cutting-edge digital services and maintaining a personal touch to retain customer satisfaction.