Klöckner & Co Sells US Sites to Boost Revenue; Defense Stocks Surge Amid European Tensions

Steel trader Klöckner & Co is selling eight US distribution sites to boost revenue from higher-value businesses. Meanwhile, the stock market today reacted to various reports and political developments, with defense stocks surging due to European tensions. Redcare, an online pharmacy, saw a share price dip following a management change.

Klöckner & Co is divesting eight US distribution sites to focus on higher-value business and service centers, aiming to increase revenue share. The company's strategic move comes as the stock market awaits key economic indicators, including the ISM purchasing managers' reports and the US jobs report, which could influence Federal Reserve rate cuts.

The stock market responded to these reports and political developments, such as the potential US government shutdown on Wednesday. The MDAX saw price increases from thyssenkrupp, Talanx, Bilfinger SE, Lufthansa, and KION Group, with Lufthansa having the highest trading volume and Porsche Vz holding the highest market capitalization. The DAX, meanwhile, showed a positive trend with the inclusion of Scout24 and GEA, replacing Porsche and Sartorius.

European stock markets in London and Zurich also experienced slight gains. The MDax rose by 0.44 percent to 30,117.57 points, while the EuroStoxx 50 closed 0.1 percent higher. In the US, the Dow Jones Industrial was down 0.2 percent, but the Nasdaq 100 gained 0.5 percent at the end of European trading. The Dax remained near 24,000 points with no new positive trading impulses at the start of the week.

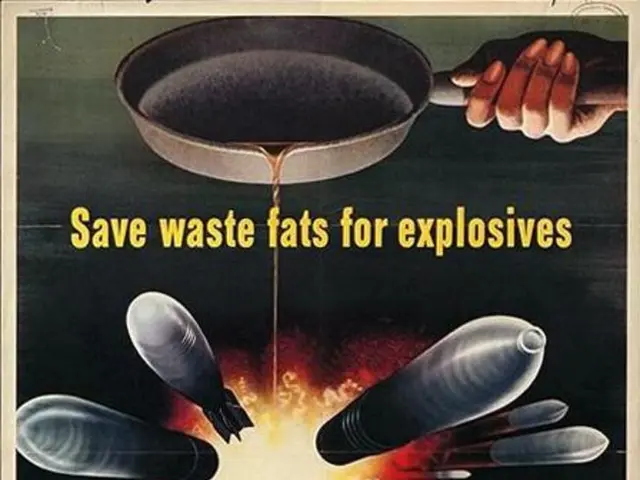

Defense stocks, such as Hensoldt, Renk, and Rheinmetall, were in high demand due to the tense security situation in Europe, setting new records. Conversely, Redcare, an online pharmacy, saw its share price drop by 5 percent following a change in the finance department and concerns about prescription growth.

Klöckner & Co's strategic move to sell US distribution sites aims to boost revenue from higher-value businesses. The stock market reacted to various reports and political developments, with defense stocks surging due to European tensions. Redcare's share price dip reflects investor concerns about management changes and prescription growth.