Digital currency Bitcoin poised to assume role of 21st century's gold standard!

Bitcoin, the digital currency that has captured the world's attention, offers a unique blend of features that make it an intriguing asset for both financial transactions and supply chain management.

The Allure of Bitcoin

Bitcoin's anonymity and global acceptance have made it popular among those seeking to maintain financial privacy. Its decentralized network allows for low transaction costs, making it a viable option for payments, especially compared to credit card payment systems. Moreover, Bitcoin holders can make payments anywhere worldwide, unlike traditional banks which are restricted to specific jurisdictions. Bitcoin users also benefit from having more control over their wealth and spending, as there is no central authority that can seize their funds.

Bitcoin's Potential as a Valuable Asset

Bitcoin's value is influenced by its limited supply and high demand, making it potentially more valuable than gold in the long term. The digital currency has seen a remarkable increase in value over the last decade, with its price skyrocketing more than 1,000 times. However, Bitcoin's price is volatile, making it difficult to determine whether it is overvalued or undervalued at any given time.

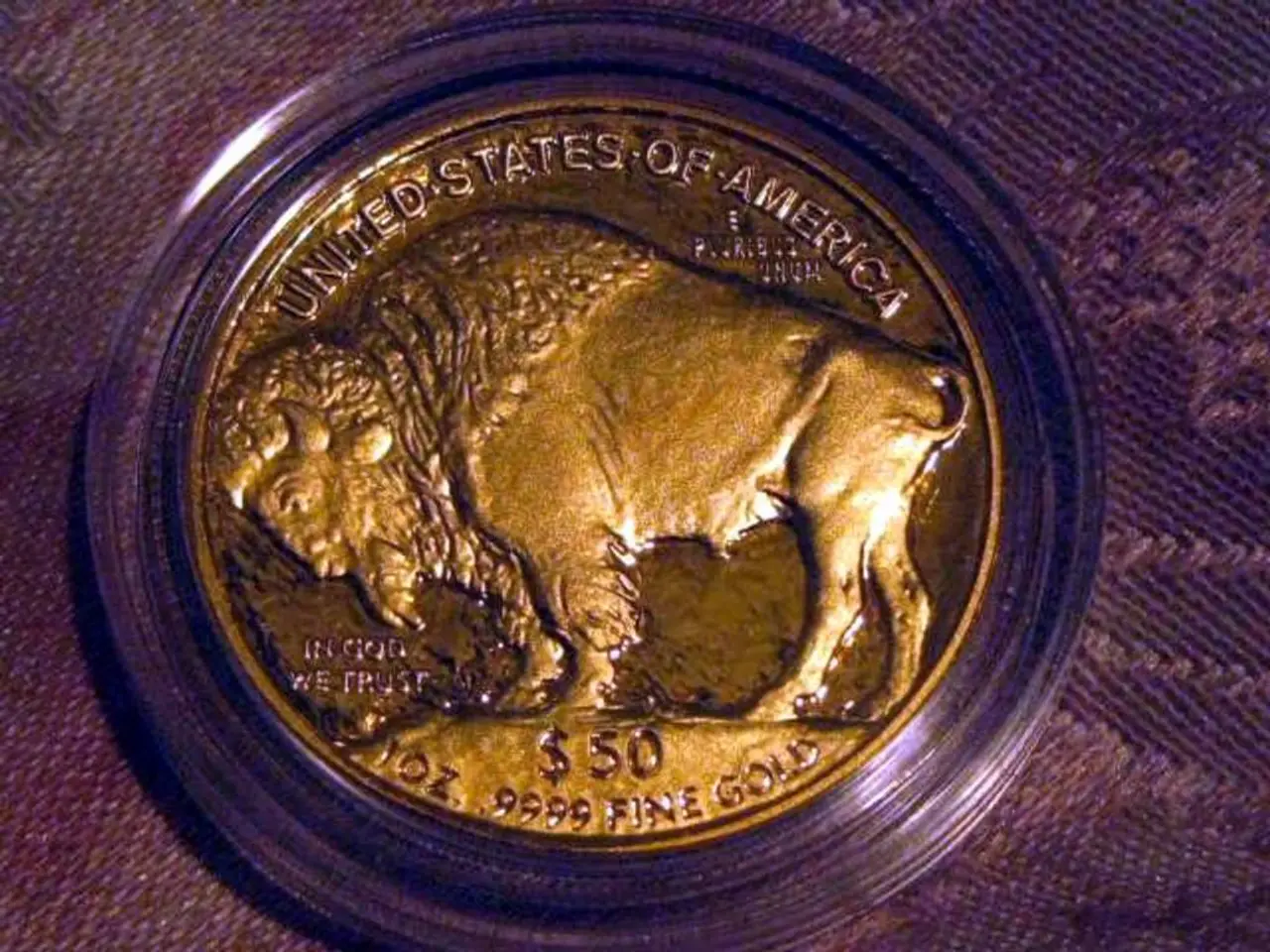

Gold's Comparison with Bitcoin

In contrast, gold offers slow-paced returns compared to Bitcoin, making it less attractive for those looking to grow their wealth quickly. Unlike gold, the exact amount of Bitcoin left to be mined is known, providing more certainty for investors. Bitcoin's keys are encrypted multiple times for added security, and its security is ensured by cryptography, making it very difficult to crack. The number of Bitcoins mined in a particular period can be adjusted, an option that gold does not have. Bitcoin also has a hard cap of 21 million coins, making it similar to gold in terms of scarcity.

The Impact of Blockchain on Supply Chains

Blockchain technology, the backbone of Bitcoin, has significantly enhanced supply chain transparency and facilitated companies' entry into previously closed markets. By using a decentralized, immutable ledger, blockchain ensures that every step of the supply chain is transparent and traceable, reducing the risk of counterfeiting and fraud. All authorized participants can access real-time data, enabling immediate response to supply chain disruptions and more efficient management of logistics.

Blockchain technology fosters trust by shifting from traditional “systems of record” to a unified “system of trust,” where the validity of records is guaranteed by a collective, decentralized network. This is particularly beneficial in regulated industries, such as pharmaceuticals, where compliance with strict regulations like the Drug Supply Chain Security Act (DSCSA) in the U.S. is mandated. By standardizing data and processes across different entities, blockchain can reduce the barriers to entry in complex regulatory environments, as seen in countries with strict import controls like China.

IBM's recent entry into China's domestic sector with a blockchain-powered trade platform demonstrates the impact of blockchain technology on the supply chain industry. The technology connects disparate systems, creating a shared record of product movement that fulfills interoperability requirements, which can be advantageous in heavily regulated markets like China.

In conclusion, Bitcoin and blockchain technology offer innovative solutions to traditional financial and supply chain challenges. Bitcoin's potential as a valuable asset and its decentralized network make it an appealing investment option, while blockchain technology enhances supply chain transparency and facilitates entry into previously closed markets.

- Investors exploring the realm of technology-oriented investments might find Bitcoin attractive, as it offers a unique potential for growth beyond traditional assets like gold.

- The integration of Bitcoin's underlying technology, blockchain, is revolutionizing various sectors, including investing and finance, by facilitating secure, transparent, and decentralized transactions.