AUSTRAC Imposes Fresh Regulations on Cryptocurrency Automated Teller Machines (ATMs) in Australia

Crypto ATM Crackdown in Australia: New Rules on the Horizon

Say goodbye to large transactions at your neighborhood crypto ATM. Australia's financial watchdog, AUSTRAC, is stepping up its game by implementing tough new rules for crypto ATM operators. The aim? To thwart scams and protect the people and businesses from falling victim.

Starting from June 2025, crypto ATMs across the country will face stricter regulations. These rules cap cash deposits and withdrawals at a maximum of AUD 5,000 (around USD 3,250). Operators will also be required to display warning signals about potential scams and beef up their identification processes for customers.

But that's not all. Operators must improve their monitoring of transactions too. For instance, they'll need to track transactions to spot patterns that could signal money laundering or scam-related activities. Failure to comply with these regulations could lead to penalties, such as refusal to renew licenses.

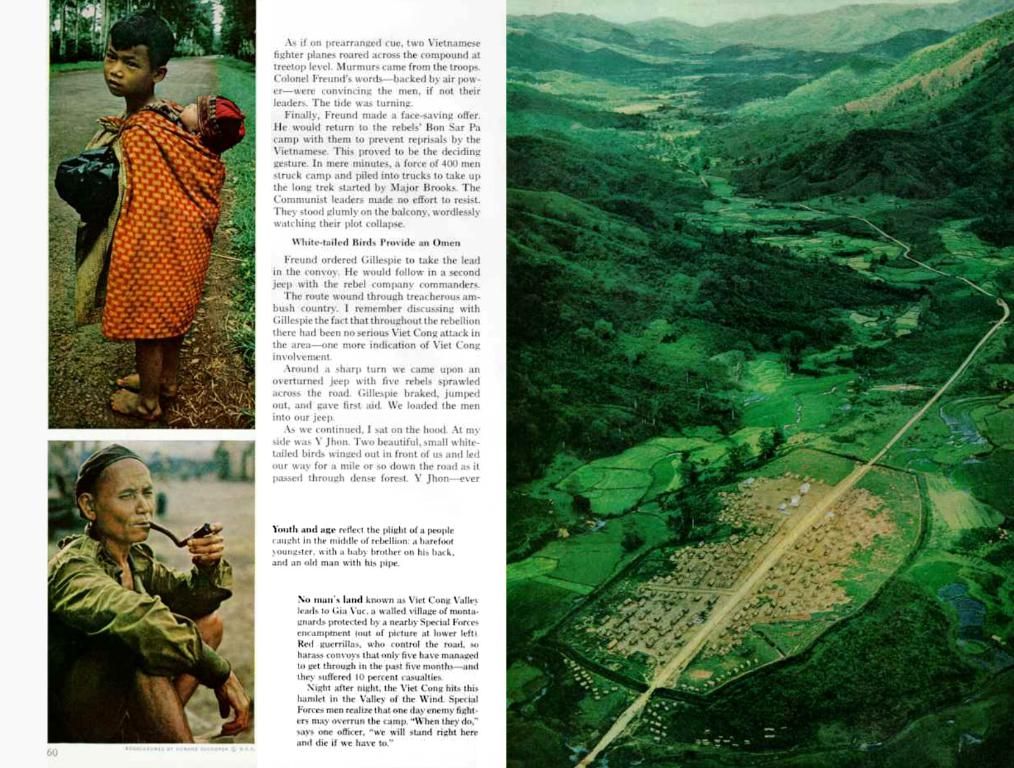

You may wonder, why the sudden crackdown? It turns out that older Australians, particularly those aged 60-70, are prime targets for scammers. According to reports, over 70% of the money spent at crypto ATMs comes from this demographic. In 2024-2025 alone, scams involving crypto ATMs resulted in over AUD 3 million in losses[6].

The Australian Federal Police (AFP) has urged victims to share their stories to help prevent others from becoming targets. The number of reported cases might be higher as many victims choose not to report scams due to embarrassment or lack of knowledge.

With the surge in crypto ATMs around Australia—from just 67 machines in August 2022 to 1,819 as of June 2025[1]—these stricter rules become even more essential. Companies like Localcoin, Coinflip, and Bitcoin Depot are just a few names setting up more machines across the country.

On March 31, 2025, AUSTRAC issued a warning notice to cryptocurrency ATM providers, alarmed by the rising allegations of money laundering and victim deception[5]. These new rules are designed to put a stop to criminals using these ATMs for illegal activities and protect innocent Australians.

In summary, these strict new rules aim to combat money laundering and scam activities by imposing cash deposit and withdrawal limits, enhancing customer verification processes, mandating scam warnings, improving transaction monitoring, and enforcing registration and compliance with AML and KYC regulations. Let's hope this will make the crypto ATM experience a safer one for all!

References:

- “Australia’s Digital Transformation Evolution Continues,” Deloitte, https://www2.deloitte.com/content/dam/Deloitte/au/Documents/About-Deloitte/deloitte-australia-digital-transformation-report-2020.pdf

- “Australia brings in crypto rules to crack down on money laundering and terrorist financing,” Decrypt, https://decrypt.co/54465/australia-introduces-bitcoin-laws-regulate-cryptocurrency

- “AUSTRAC’s new powers to tackle dangerous new criminal trends and money laundering,” AUSTRAC, https://www.austrac.gov.au/media/2021-news/austracs-new-powers-tackle-dangerous-new-criminal-trends-and-money-laundering

- “Digital Currency Exchanges (DCE) Solidifies Existing Rules Regarding Registration with AUSTRAC,” Kaine Law, https://www.kainelaw.com.au/articles/digital-currency-exchanges-dce-solidifies-existing-rules-regarding-registration-with-austrac/

- “AUSTRAC issues crypto ATM warning,” The Australian Financial Review, https://www.afr.com/business/austrac-issues-crypto-atm-warning-20250331-p5anet

- “Bitcoin ATMs Alleged to be Used in Money Laundering in Australia,” Australian Crime Commission, https://www.acu.edu.au/sites/default/files/Auction%20In%20Eau%20-%20ACSJL%20Research%20Report%20-%20Final%20-%20Proofed%20-%20May%202020.pdf

- The new regulations for crypto ATM operators in Australia, starting from June 2025, aim to limit the risk of crypto exchanges and digital currencies like Bitcoin being used for money laundering or scams, as reported in general-news and crime-and-justice sectors.

- The tough new rules will cap cash deposits and withdrawals to AUD 5,000 (around USD 3,250) and mandate crypto ATM operators to monitor transactions, display warning signs about potential scams, and enhance identification processes for customers, all steps designed to protect people and businesses from falling victim.

- With the growth in the number of businesses involved in the crypto industry, such as Localcoin, Coinflip, and Bitcoin Depot, the need for these stricter regulations has become more pressing, as the surge in crypto ATMs around Australia has made it easier for criminals to carry out illegal activities.

- As the federal government and law enforcement agencies like the Australian Federal Police (AFP) address the rising crime in the crypto industry, it is crucial for the general public to stay informed and active, especially when it comes to sharing stories and reporting incidents related to money laundering, scams, or other illegal activities associated with cryptocurrency.